Your credit score is essential for your financial health. From buying a house to getting loans, your score influences many important decisions. But why is my credit score dropping without warning?

At Texas Car Title and Payday Loan Services, Inc., we understand how challenging this can be. In this guide, we’ll explain the top reasons for a drop and how an online title loan in Texas can help you recover fast.

Common Reasons for a Drop in Your Credit Score

Late or Missed Payments

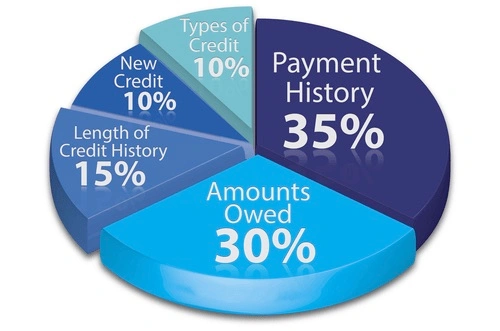

Missing or making a late payment on any of the accounts that are reported to credit agencies can lower your credit score. Since payment history accounts for 35% of your credit rating, you can see why sticking to your monthly payment schedule is important. If you have recently missed a payment, be sure to pay it as soon as possible to avoid any decline in your score. With approval in as little as 30 minutes, you can use an instant online title loan to avoid late fees and protect your credit score.

Making Payments

If you need help making a payment, so that you do not experience a drop in your credit, or get hit with late fees, you may want to consider using an instant online title loan. At Texas Car Title and Payday Loan Services, Inc. you can get approved and receive the extra cash you need with a title loan in 30 minutes or less.

High Credit Utilization

Credit utilization is a major factor in configuring a credit score. It is the credit to debt ratio between what you owe and your total credit limit. While you may be approved for $1,000 in credit, you should only utilize 30%, or $300, of that to keep your credit in good standing. Anything higher than 30% can result in a drop in your score. If you need to pay down credit card debt quickly, an online title loan in Texas could help. By using your vehicle’s value as collateral, you can get a loan to reduce your debt and keep your credit utilization in check.

New Credit Inquiries

Anytime you make an inquiry on your credit it takes a hit. Whether that hit is of no importance or will certainly make an impact is determined by the type of inquiry that is made. Some inquiries are considered to be a “soft” inquiry that will have little to no impact on your credit, while a “hard” inquiry will have a higher impact. With a title loan in Texas, you can access money based on your car’s value, not your credit score.

Closing a Credit Card

Closing a credit card, while you have other accounts open can affect your credit. Since credit utilization is a factor, as mentioned already, you should only be utilizing 30% of your total credit limit. So, when closing a credit card, it is important to know that the credit limit on that card will be deducted from your total credit limit and can cause your utilization to rise above 30%. Instead of closing a credit card, consider using an online title loan to pay off existing debt, which can help maintain a lower credit utilization ratio and keep your score intact.

Credit Limit Decreases

If a credit limit is lowered, it would have the same effect as if you closed an account. The credit utilization will come into play, and again, if you are using more than 30% of your total credit limit than your credit score can drop. If your credit limit has been reduced and you need help paying off your debt to keep your score from plummeting, consider applying for an online title loan in Texas. With a title loan, you can quickly access cash to manage your debt and avoid further damage to your credit.

Errors on Your Credit Report

While it does not happen often, mistakes can happen, causing inaccurate credit reporting on your accounts. You may also find yourself in this situation if you have been a victim of fraud or identity theft. This is another reason why it is important to monitor your credit and the activity in your accounts. In the meantime, an instant online title loan can help you manage any immediate financial needs. This loan allows you to borrow against your vehicle’s value, making it an ideal solution if you’re facing financial struggles while correcting errors on your credit report.

How Online Title Loans Can Help

If unexpected expenses or high bills are impacting your ability to make payments, consider a title loan. With Texas Car Title and Payday Loan Services, Inc., you can:

- Get approved in as little as 30 minutes.

- Borrow based on your vehicle’s value, not your credit score.

- Use the funds to stay on top of payments and avoid credit damage.

Start your Online Title Loan application here.

Take Control of Your Credit Today

Your credit score doesn’t have to control your life. By understanding why your credit score is dropping and taking action with solutions like an online title loan in Texas, you can stay on track financially.

Fixing a credit score drop takes time, but with good habits and smart financial tools, you can get back on the right path.

Need fast help? Learn more about how Online Title Loans in Texas can support your financial goals.

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.